Finance is a crucial aspect of life, impacting everything from personal budgets to global economies. Whether you’re managing your own finances or aiming for a career in finance, mastering financial principles is essential. In this comprehensive guide, we will delve into expert tips and strategies that can help you navigate the complexities of finance with confidence and skill.

1. Understanding the Basics of Finance

To master finance, you need a solid understanding of its fundamental concepts. This section covers essential topics such as:

1.1. Definition and Importance of Finance

1.2. Key Financial Terms and Definitions

1.3. Basic Principles of Accounting

1.4. Different Types of Financial Markets

1.5. Overview of Economic Factors Affecting Finance

2. Developing Financial Literacy

Financial literacy is about knowing how to manage money effectively. Here, we explore:

2.1. Importance of Financial Literacy

2.2. How to Improve Your Financial Literacy

2.3. Recommended Books and Resources for Financial Education

2.4. Understanding Credit Scores and Reports

2.5. Budgeting Techniques and Tools

3. Personal Finance Management

Effective management of personal finances is crucial for financial stability and growth. Topics covered

include:

3.1. Creating a Personal Budget

3.2. Savings and Investment Strategies

3.3. Managing Debt: Tips and Best Practices

3.4. Retirement Planning and Investments

3.5. Insurance Planning for Financial Security

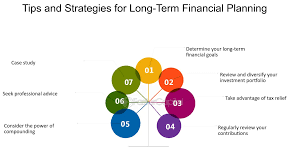

4. Advanced Financial Planning

For those looking to delve deeper into finance, advanced planning strategies are essential:

4.1. Investment Portfolio Diversification

4.2. Tax Planning Strategies

4.3. Estate Planning and Wealth Management

4.4. Risk Management in Finance

4.5. Long-term Financial Planning for Goals

5. Career Paths in Finance

Finance offers diverse career opportunities. Here, we discuss:

5.1. Popular Finance Career Paths

5.2. Skills and Qualifications Needed in Finance

5.3. Networking and Professional Development Tips

5.4. Navigating the Finance Job Market

5.5. Career Growth and Advancement Strategies

6. Emerging Trends in Finance

Stay updated with the latest trends shaping the finance industry:

6.1. Impact of Technology on Finance (Fintech)

6.2. Sustainable Finance and ESG Investing

6.3. Global Economic Trends and Their Implications

6.4. Regulatory Changes in Finance

6.5. Future Outlook: Predictions and Insights

7. Financial Strategies for Businesses

Business finance requires specialized knowledge. This section covers:

7.1. Financial Planning for Startups

7.2. Managing Cash Flow Effectively

7.3. Funding Options for Business Growth

7.4. Financial Risk Management in Business

7.5. Financial Statements and Analysis

8. Case Studies and Real-world Examples

Learning from real scenarios can enhance your understanding. Here, we analyze:

8.1. Successful Financial Strategies of Companies

8.2. Case Studies on Financial Failures and Lessons Learned

8.3. Personal Finance Success Stories

8.4. Impactful Financial Decisions in History

8.5. Ethical Dilemmas in Finance and Resolutions

9. Behavioral Finance: Understanding Investor Psychology

Explore how psychology influences financial decisions:

9.1. Cognitive Biases in Financial Decision Making

9.2. Emotional Intelligence and Financial Success

9.3. Investor Behavior During Market Volatility

9.4. Strategies to Overcome Behavioral Biases

9.5. Role of Financial Advisors in Behavioral Finance

10. Continuous Learning and Adaptation

Finance is dynamic; continuous learning is key:

10.1. Importance of Lifelong Learning in Finance

10.2. Keeping Up with Industry Changes

10.3. Professional Certifications in Finance

10.4. Online Courses and Educational Platforms

10.5. Building a Personalized Learning Path

Conclusion

Mastering finance involves acquiring knowledge, applying strategies, and adapting to changes in the financial landscape. By understanding the fundamentals, developing financial literacy, and exploring advanced strategies, you can confidently navigate personal and professional financial challenges.